Mumbai, October 19, 2025— As India’s economy continues to expand post-pandemic, financial experts are encouraging individuals to take a more strategic approach toward investing. The question on every aspiring investor’s mind — “Where should I invest my money?” — has never been more relevant.

Understanding the Investment Landscape

According to recent data from the National Stock Exchange, retail participation in equity markets has risen by 28% over the past year. “The surge in new investors reflects a growing financial awareness among young professionals,” said Ramesh Gupta, a certified financial planner based in Mumbai.

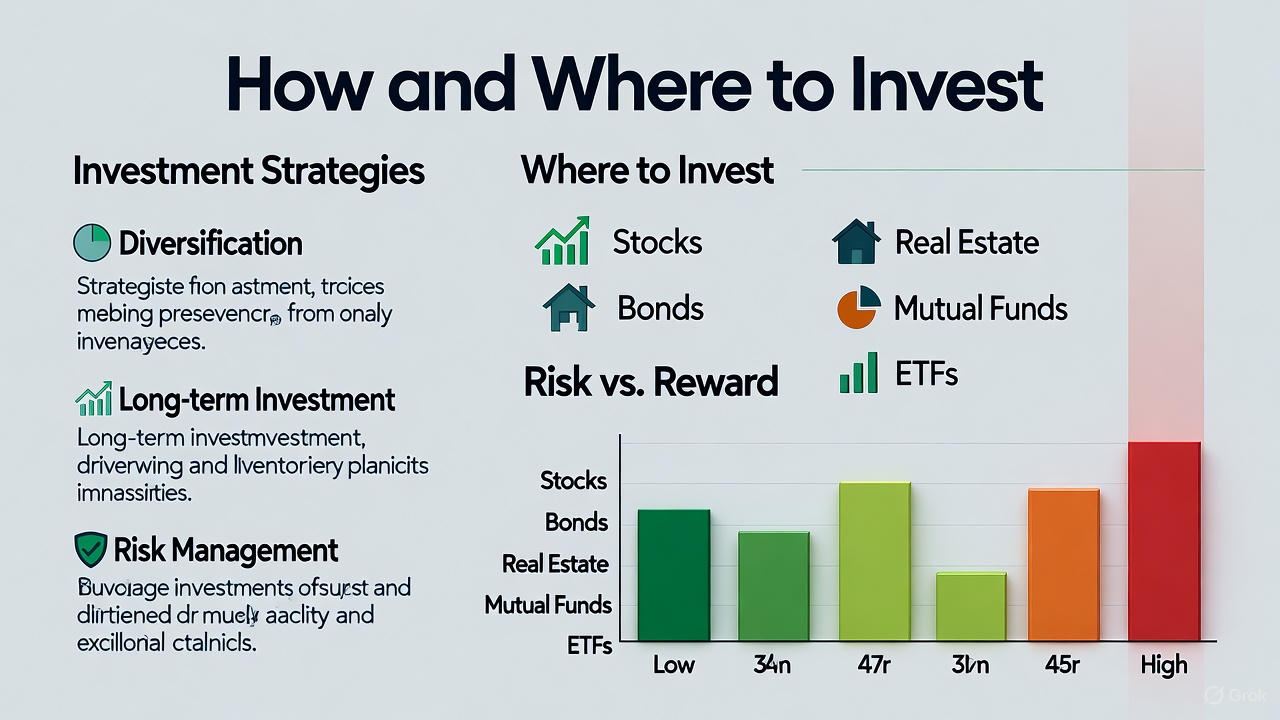

However, experts caution that not all investments yield the same results. Traditional assets like fixed deposits and gold continue to attract risk-averse investors, while those seeking higher returns are exploring mutual funds, ETFs, and government bonds.

Expert Opinions and Strategies

“The best investment strategy today is one that balances growth with security,” said Meera Iyer, Head of Research at FinVista Capital. “Diversification — across stocks, real estate, and debt instruments — is key to long-term wealth creation.”

Investment advisors emphasize that digital platforms have made it easier than ever for individuals to start small. “Even with ₹500 a month, you can begin your investment journey through SIPs,” noted Arun Tiwari, a financial consultant from Pune.

Meanwhile, real estate is regaining investor confidence, particularly in Tier 2 cities like Indore and Coimbatore. According to market analysts, rising urban development and infrastructure projects have made property investment a viable long-term option once again.

Balancing Risk and Reward

Experts also urge caution amid global uncertainties. Inflation, geopolitical tensions, and fluctuating interest rates can all affect returns. “Risk management and financial education are crucial,” Iyer added. “Investors must focus on long-term goals instead of chasing short-term profits.”

The Road Ahead

With the Reserve Bank of India maintaining a balanced monetary stance and global markets showing signs of recovery, analysts expect continued growth in 2025. For now, the mantra remains clear — start early, diversify widely, and invest consistently.

Comments

No comments yet. Be the first to comment!