Dallas, Oct. 10, 2025 (AP)— Applied Digital Corporation (Nasdaq: APLD), the developer and operator of advanced digital infrastructure for AI and high-performance computing (HPC), today reported its first-quarter results, posting strong revenue growth that outpaced market expectations amid continued investment in data center capacity.

Context & Background

Context & Background

In the quarter ending August 31, 2025, Applied Digital recorded $64.22 million in revenue, marking an 84 % increase from the comparable period a year ago. Benzinga The surge was largely driven by growth in its data center hosting and cloud-services operations, especially revenue tied to tenant “fit-out” services in its HPC hosting segment. Benzinga+1

Despite this top-line strength, the company still reported an adjusted per-share loss of $0.03, outperforming analyst estimates of a $0.13 loss. Benzinga Net losses remain, in part, due to ramp-up costs, depreciation, and investments in new facilities not yet at full utilization. Invezz+2Yahoo Finance+2

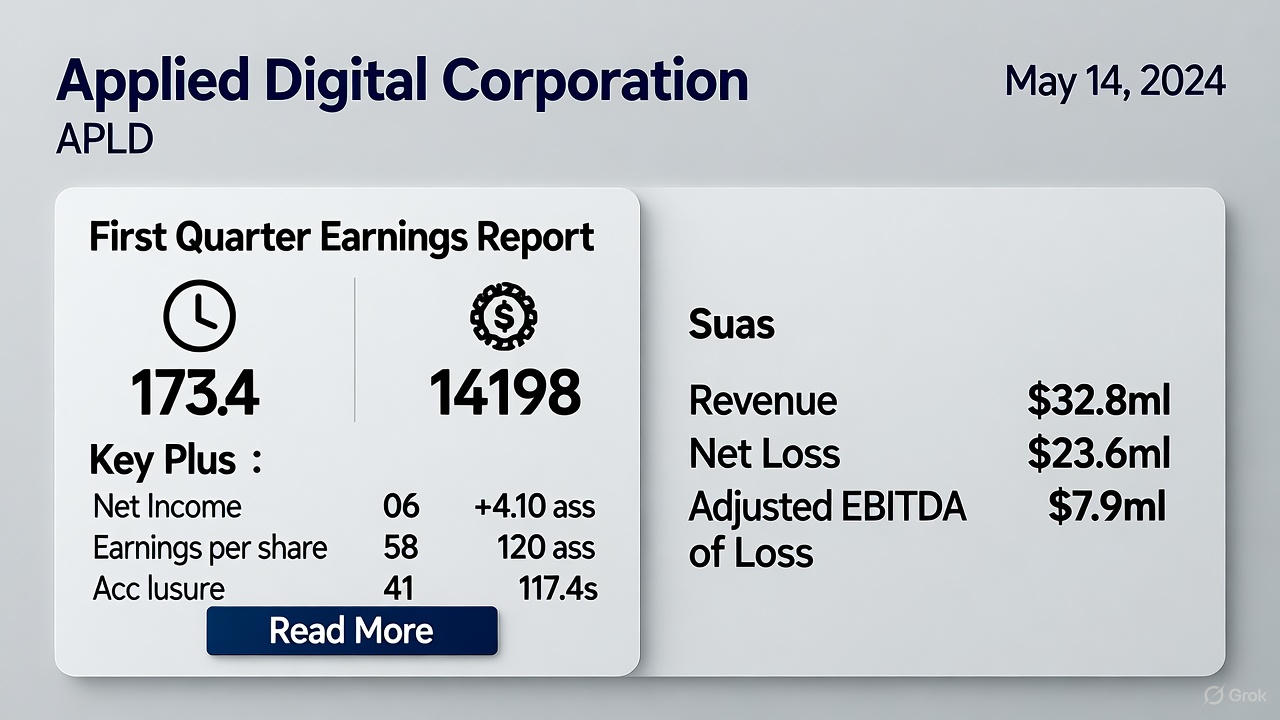

This quarter’s performance builds on Applied Digital’s earlier results: for fiscal Q1 2025, the company had reported $60.70 million in revenue (up 67 %) and a net loss of $4.2 million (or $0.03 per share). Stock Titan+2Seeking Alpha+2 That showed an ability to scale, though profitability remained elusive. Applied Digital Corporation+1

Key Highlights & Quotes

Revenue beat: The $64.22 million realized well exceeded estimates of ~$50 million. Benzinga+1

Adjusted loss narrower: The –$0.03 per share adjusted loss beat expectations of –$0.13. Benzinga

Operational drivers: Tenant infrastructure (fit-out) services contributed ~$26.3 million. Benzinga

Strategic position: Analysts describe the company as a “modern-day picks and shovels” play in AI infrastructure. Benzinga

Wes Cummins, CEO of Applied Digital, said,

“As demand for AI accelerates exponentially, we believe that we are uniquely positioned to deliver substantial returns while supporting evolving infrastructure needs.” Applied Digital Corporation+2Yahoo Finance+2

Meanwhile, financial commentary has flagged some caution:

“The stock’s post-earnings rally ignores these 3 red flags,” warns one analysis, pointing to continued capital intensity, operational risk, and timing on full facility ramp-up. Invezz

Balanced View & Risks

While the revenue growth is impressive, challenges remain. The company must manage high fixed costs, depreciation, and delay in monetization for newer facilities. Invezz+1 The adjusted loss shows profitability is still out of reach, even though the gap is narrowing. Benzinga+1 Some market watchers caution that the stock’s rise may overextend expectations relative to near-term earnings stability. Invezz

Additionally, in January 2025, Macquarie Group announced a potential investment of up to $5 billion into Applied Digital’s AI data center pipeline, including a $900 million commitment to its North Dakota campus. Reuters That deal underscores both confidence in growth potential and the capital demands ahead.

What’s Next

Looking forward, Applied Digital aims to continue its build-out of high-density HPC data centers (notably its Ellendale campus) and deepen leasing with AI tenants. Benzinga+4Applied Digital Corporation+4Seeking Alpha+4 The coming quarters will be crucial: if it can bring more facilities online and increase utilization, the path toward break-even or better could accelerate.

Investors and industry watchers will watch for:

Updated lease announcements and tenant commitments

Trends in margins as newer data halls ramp up

Capital funding or debt management moves

Guidance for the remainder of fiscal 2026

Comments

No comments yet. Be the first to comment!